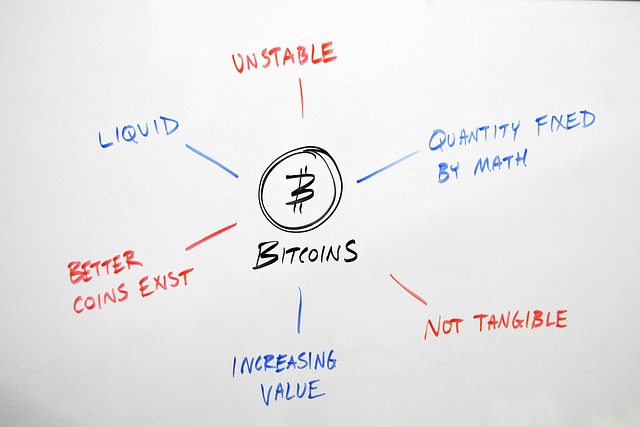

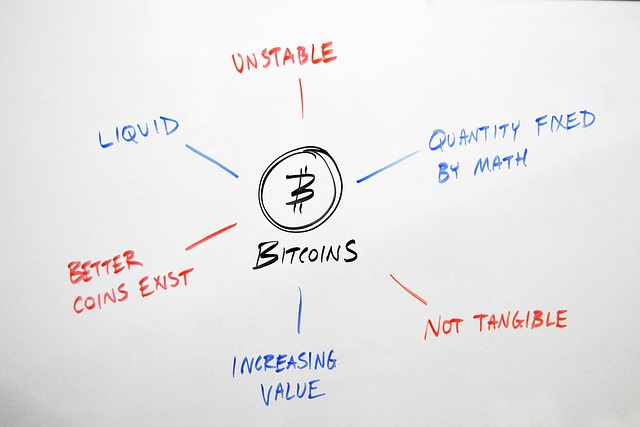

Digital checks, though efficient and accessible, face significant drawbacks like security concerns, fraud risks, privacy issues, and technical glitches, which can lead to transaction errors and user distrust. Despite their advantages, these challenges must be addressed for seamless and secure financial transactions in the digital era.

In today’s digital era, switching to digital checks has seemed like an inevitable step forward. However, before businesses embrace this trend blindly, it’s crucial to weigh the pros and cons. While digital checks offer enhanced efficiency, accessibility, and cost savings for businesses, they also come with significant drawbacks such as security concerns, technical glitches, potential fraud, and privacy risks. Understanding these pros and cons is vital for making an informed decision regarding online payment methods.

- Advantages of Digital Checks: Enhanced Efficiency and Accessibility

- Drawbacks of Online Checks: Security Concerns and Technical Glitches

- Cost Savings and Speed Benefits for Businesses

- Potential Risks: Fraud, Privacy, and Consumer Protection

Advantages of Digital Checks: Enhanced Efficiency and Accessibility

Digital checks offer several advantages over traditional paper-based methods, making them an attractive option for businesses and individuals alike. One of the key benefits is enhanced efficiency and accessibility. With digital checks, transactions can be processed faster and more accurately due to automated systems that reduce manual errors and streamline the entire process. This efficiency gain is particularly noticeable in high-volume scenarios, where handling physical checks can become cumbersome and time-consuming.

Additionally, digital checks provide unparalleled accessibility. They eliminate geographical barriers, enabling businesses and their customers to conduct transactions from anywhere with an internet connection. This flexibility benefits both parties, as it allows for remote work arrangements for financial institutions and convenient, contact-free interactions for consumers. Despite the numerous drawbacks of online checks, these advantages highlight why digital checks are gaining popularity in today’s digital era.

Drawbacks of Online Checks: Security Concerns and Technical Glitches

The drawbacks of online checks are primarily centered around security concerns and technical glitches, which can significantly impact their reliability. While digital payment systems offer convenience and speed, they also present potential vulnerabilities. Cyberattacks, identity theft, and fraud are persistent risks associated with electronic transactions. Personal information shared during the check-writing process could fall into malicious hands, leading to financial losses and other detrimental consequences.

Moreover, technical glitches often arise in online banking platforms and payment gateways. System failures, software bugs, or connectivity issues can disrupt the smooth flow of funds, causing delays, errors, or even failed transactions. These glitches not only frustrate users but also erode trust in digital check-based systems, emphasizing the need for robust security measures and reliable infrastructure to mitigate these drawbacks.

Cost Savings and Speed Benefits for Businesses

Businesses have long relied on traditional paper checks for financial transactions, but the digital age has brought about a shift towards electronic payments, including digital checks. While there are numerous benefits to this transition, it’s crucial to weigh them against potential drawbacks, especially when considering the drawbacks of online checks.

One of the most significant advantages is cost savings and speed improvements. Digital checks eliminate the need for printing, mailing, and handling physical documents, reducing overhead expenses for businesses. They also streamline the clearing process, allowing for faster settlement times. This efficiency gains can translate into substantial time and money savings, particularly for companies processing a high volume of transactions. However, these benefits must be balanced against security concerns and potential technical glitches that could impact smooth operations.

Potential Risks: Fraud, Privacy, and Consumer Protection

While digital checks offer numerous conveniences, there are several potential risks associated with this mode of payment that must be considered. One of the primary concerns is fraud. Online transactions provide criminals with new avenues to perpetrate scams, such as identity theft and unauthorized use of financial information. The ease of conducting transactions digitally also means consumers may face heightened exposure to these fraudulent activities.

Privacy is another significant drawback of online checks. Digital transactions require sharing sensitive personal and financial data, which can increase the risk of data breaches or unauthorized access. As more aspects of daily life shift online, so does the target for cybercriminals looking to exploit vulnerabilities in security measures. Additionally, consumer protection laws may not offer the same level of safeguards in digital transactions as they do with traditional checks, leaving individuals potentially vulnerable to disputes and financial losses.